Ever heard the phrase “investment banking” and wondered what it really means? Or maybe you’re considering a career in finance and want to understand this high-stakes field better.

Well, you’ve come to the right place! Welcome to this guide on investment banking, where we’ll break down the complex world of high finance into easy-to-understand concepts. We’ll explore what investment banks do, the different roles within them, and the skills you need to succeed in this exciting industry.

Whether you’re a curious student, a budding finance professional, or simply someone interested in learning more about the financial world, this blog is for you. Let’s dive in and demystify the world of investment banking together!

What is Investment Banking?

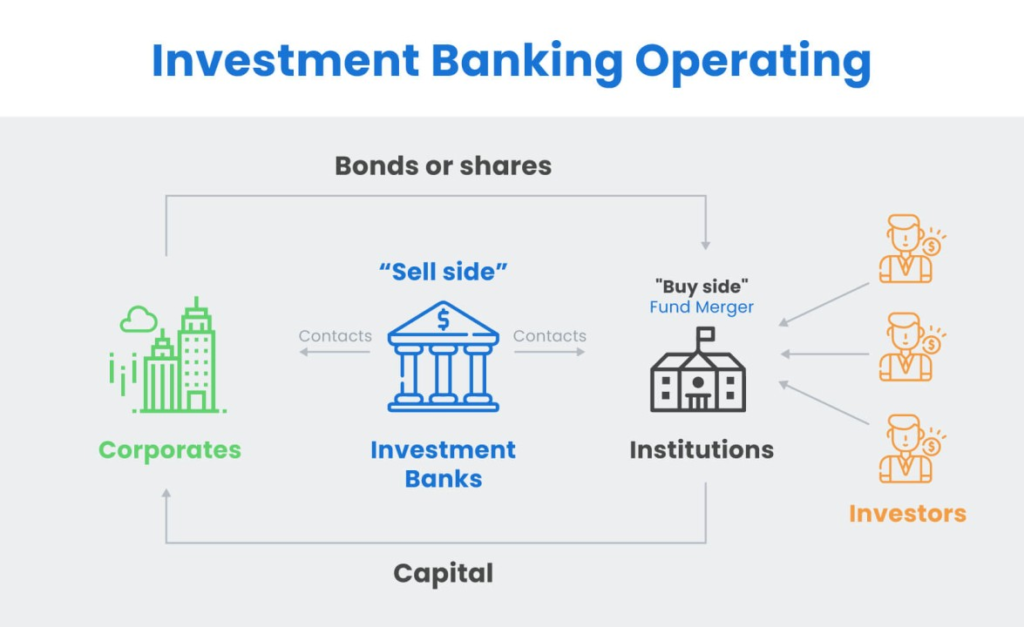

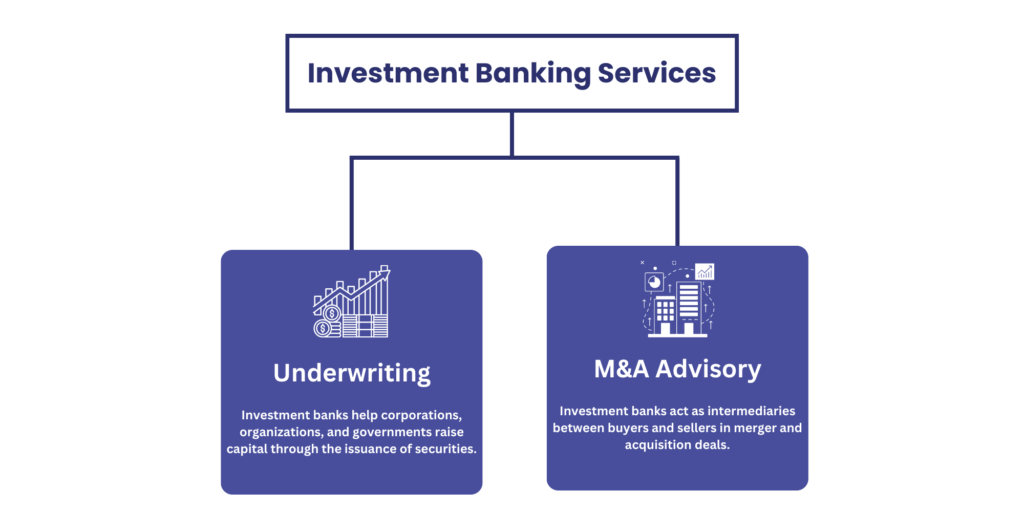

Investment banking refers to the division of a financial institution that focuses on the creation of capital for other companies, governments, and other entities. It provides underwriting services for new securities, aids in mergers and acquisitions (M&A), offers advisory services on complex financial transactions, and manages the trading of financial instruments such as bonds, stocks, and derivatives.

An investment bank is distinctly different from a commercial or retail bank. Retail banks primarily deal with individual customers and offer services like savings accounts, personal loans, and mortgages. Investment banks, on the other hand, serve large corporations, institutional investors, and governments, specializing in high-level financial services that involve a significant degree of risk and expertise.

Investment banking activities are typically divided into two main areas:

- Advisory and Corporate Finance – Includes underwriting, mergers and acquisitions, and advisory roles.

- Sales and Trading – Involves facilitating the buying and selling of securities for clients or engaging in proprietary trading for the bank itself.

The History and Evolution of Investment Banking

The origins of investment banking can be traced back to the early days of commerce and trade, but it began taking shape as a distinct industry in the 19th century. Here’s a brief timeline of its evolution:

- Early Foundations (Pre-19th Century)

The early functions of what would later become investment banking began with merchants and traders who facilitated the flow of capital in major European cities like Venice and Florence during the Renaissance. These financial intermediaries laid the foundation for the modern concept of investment banks. - Rise of Investment Banks in the U.S. (19th Century)

In the United States, investment banking emerged in the 1800s with institutions like J.P. Morgan and Goldman Sachs, which helped industries such as railroads and steel raise capital for expansion. J.P. Morgan played a key role in financing major infrastructure projects and consolidating industries, often referred to as “Morganization.” - Post-War Growth and Regulation (20th Century)

Following the stock market crash of 1929 and the Great Depression, the Glass-Steagall Act of 1933 introduced the separation of investment and commercial banking in the U.S., limiting the risk exposure of banks. This period saw investment banks specialize in underwriting, advisory services, and trading. - Globalization and Expansion (Late 20th Century)

The repeal of the Glass-Steagall Act in 1999, through the Gramm-Leach-Bliley Act, allowed investment banks to merge with commercial banks, leading to the rise of “universal banks” like Citigroup. This period saw a massive expansion of investment banking operations globally. - The 2008 Financial Crisis and Beyond

The financial crisis of 2008, triggered in part by excessive risk-taking by investment banks, led to tighter regulations like the Dodd-Frank Act in the U.S. Investment banks had to adapt to a more cautious regulatory environment, and many restructured their operations to become leaner and more risk-averse.

Today, investment banks continue to play an essential role in capital markets, but they operate within a more regulated and globalized financial system.

Key Functions of Investment Banks

Investment banks perform a variety of functions essential to the global economy. These functions go beyond the mere facilitation of transactions, extending into advisory services, risk management, and even the creation of new financial products. The key functions include:

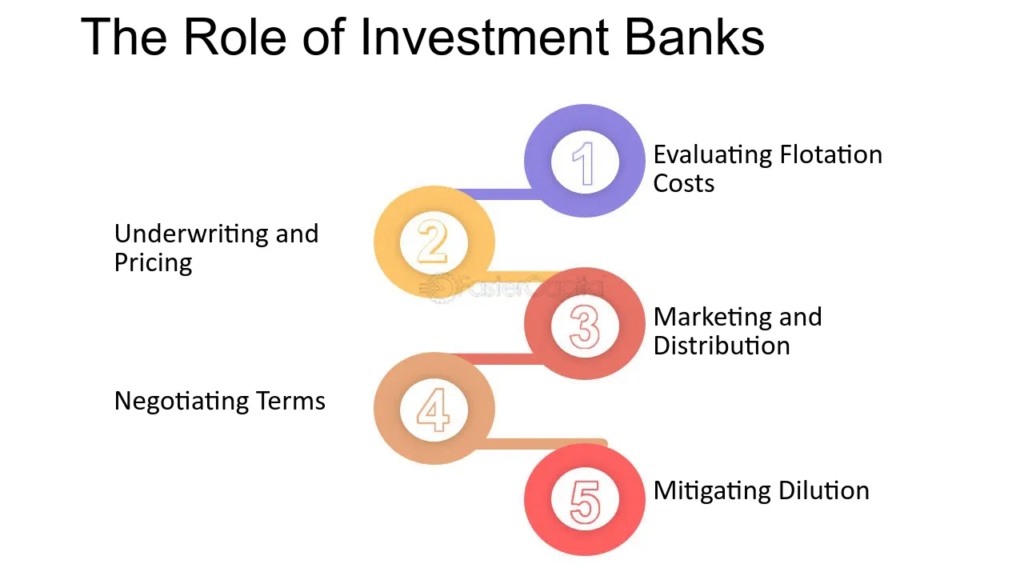

- Underwriting

One of the core activities of investment banks is underwriting securities, which involves helping companies raise capital through the issuance of stocks or bonds. Investment banks assume the risk by purchasing the securities from the issuer and reselling them to investors. There are two main types of underwriting:- Firm Commitment: The bank buys the entire issue from the company and assumes the risk of selling it.

- Best Efforts: The bank does not guarantee the sale of the securities but acts as an agent to try and sell as much as possible.

- Mergers and Acquisitions (M&A) Advisory

Investment banks play a pivotal role in M&A deals by advising companies on potential acquisitions, mergers, divestitures, and other restructuring efforts. They help identify synergies, negotiate deals, and provide valuation services to ensure that both the acquiring and target companies get the best terms possible. - Financial Advisory

Besides M&A, investment banks offer financial advisory services for a wide range of corporate actions such as debt restructuring, recapitalization, corporate spin-offs, and more. They provide strategic advice based on deep market insights and data analysis. - Sales and Trading

The sales and trading division of an investment bank acts as an intermediary between buyers and sellers of securities. Investment banks offer liquidity to the market by continuously providing quotes for securities, which enables smooth trading operations. They also engage in proprietary trading, using the bank’s own money to trade for profit. - Market Making

Market making is an essential service provided by investment banks, wherein they quote both a buy and sell price for a security to facilitate its trading. This ensures liquidity in the market and reduces the bid-ask spread, making trading more efficient for all market participants. - Research and Analysis

Many investment banks have dedicated research divisions that provide equity and fixed-income research. Research analysts produce detailed reports on industries, companies, and the economy, offering insights that help investors make informed decisions. Research also plays a key role in supporting the sales and trading functions. - Asset Management

Investment banks often offer asset management services to institutional clients and high-net-worth individuals. They manage investments on behalf of their clients, aiming to maximize returns while managing risk. These services include portfolio management, wealth advisory, and alternative investments. - Derivatives and Structured Products

Investment banks are major players in the derivatives market. They create and trade complex financial products, including options, futures, swaps, and structured products like collateralized debt obligations (CDOs). These products help clients hedge risks or speculate on market movements.

Structure of Investment Banking Divisions

Investment banks are structured into several key divisions, each focused on specific services or areas of expertise. Understanding these divisions helps illustrate the complexity and breadth of an investment bank’s operations:

- Corporate Finance / Advisory Division

This division provides advisory services for mergers and acquisitions, corporate restructuring, and capital-raising activities. Teams within this division work closely with clients to deliver strategic advice and support them through complex transactions. - Sales and Trading Division

The sales and trading division serves institutional clients by facilitating the buying and selling of securities. It is divided into:- Sales: The sales team builds relationships with clients, offering them trading ideas and connecting them to traders.

- Traders: Traders execute the actual buying and selling of securities, making markets, and ensuring liquidity.

- Proprietary Trading: This involves trading the bank’s own capital for profit, although regulatory changes have limited this activity.

- Research Division

The research division is tasked with providing insights and forecasts on various markets, sectors, and companies. Research analysts produce detailed reports based on rigorous analysis and present investment recommendations such as “buy,” “sell,” or “hold.” - Risk Management Division

Risk management is a critical function within investment banks, particularly given the complex and high-stakes nature of the transactions they facilitate. This division focuses on identifying, assessing, and mitigating risks across the bank’s operations, including market risk, credit risk, and operational risk. - Asset Management Division

The asset management division oversees the investment of clients’ funds in various financial instruments, with the goal of maximizing returns. This division typically offers investment products such as mutual funds, hedge funds, and pension funds. - Compliance Division

Given the highly regulated nature of investment banking, compliance is an integral division within any firm. The compliance team ensures that the bank adheres to laws, regulations, and internal policies, safeguarding against legal or regulatory breaches.

READ MORE: How to Resolve Clogged Radiators in Cars: Symptoms, Causes, and Solutions

Role of Investment Bankers

Investment bankers are the lifeblood of any investment bank. Their role is multifaceted, requiring both technical skills and strong interpersonal abilities. Here’s a closer look at their responsibilities:

- Financial Modeling

Investment bankers spend a significant portion of their time building financial models to assess the performance of companies, forecast financial outcomes, and analyze the impact of potential deals. These models are essential tools in advising clients on complex financial transactions. - Client Relationship Management

Investment bankers must build and maintain strong relationships with clients. They regularly meet with senior executives of corporations, understand their strategic objectives, and provide advice on how to achieve their financial goals. This relationship management often involves regular communication, understanding client needs, and presenting customized solutions to meet those needs.

- Deal Structuring and Execution

One of the key responsibilities of investment bankers is structuring deals such as mergers, acquisitions, IPOs, or debt issuances. This involves negotiating terms, determining the financial structure (e.g., cash, stock, debt), and ensuring regulatory compliance. Investment bankers guide clients through the entire process, from due diligence to deal closure. - Valuation and Due Diligence

Valuing a company accurately is one of the most critical functions of investment bankers. They use various valuation techniques such as discounted cash flow (DCF), comparable company analysis, and precedent transactions to arrive at a fair value for the company or asset being bought, sold, or restructured. During M&A, due diligence is performed to ensure there are no hidden liabilities or risks. - Advisory and Strategic Consulting

Investment bankers serve as strategic advisors to their clients. They help companies navigate complex financial decisions, including growth strategies, divestitures, and capital raising. Bankers advise on the best financial practices and help companies prepare for future market conditions or business transformations. - Regulatory and Legal Navigation

Given the regulatory complexity surrounding many transactions, investment bankers work closely with legal teams to ensure all aspects of the deal comply with relevant laws and regulations. This can include antitrust reviews for mergers, SEC filings for public offerings, or cross-border transaction regulations.

Investment Banking Services Explained

Let’s take a more detailed look at the specific services that investment banks offer:

1. Equity Financing

Equity financing refers to the process of raising capital by selling shares of a company. Investment banks assist companies in raising funds by issuing equity (stocks) in the following ways:

- Initial Public Offerings (IPO): This is when a company offers its shares to the public for the first time. Investment banks guide the entire IPO process, including pricing the stock, preparing legal documents, and marketing the stock to institutional investors through roadshows.

- Follow-on Offerings: For companies that are already public, a follow-on offering allows them to issue additional shares to raise more capital. Investment banks help these companies execute these secondary offerings by determining the appropriate pricing and market timing.

- Private Placements: In this type of equity financing, investment banks help companies raise capital without going public by issuing shares directly to private investors. These placements are usually marketed to institutional investors, private equity firms, or hedge funds.

2. Debt Financing

Debt financing is the process by which companies raise money by issuing bonds or other forms of debt securities. Investment banks help structure these debt offerings and sell them to investors. The two most common types of debt financing services include:

- Corporate Bonds: Investment banks assist corporations in issuing bonds, determining the amount of capital needed, the interest rate (coupon), and the term of the bond. They underwrite the issuance and market the bonds to institutional investors.

- Syndicated Loans: In this process, an investment bank arranges a loan that is provided by a group of lenders rather than a single lender. The bank coordinates the transaction and helps the borrower secure favorable terms.

3. Mergers and Acquisitions (M&A)

M&A advisory services are a core offering of investment banks. They assist companies in both buy-side (acquiring another company) and sell-side (selling or merging) transactions. Services provided by investment banks in M&A include:

- Deal Origination: Investment banks often help companies identify potential acquisition targets or buyers. They also provide insights into market trends, competitor analysis, and valuations to guide decision-making.

- Negotiation and Execution: Investment banks negotiate terms on behalf of their clients, including price, structure, and financing. They also ensure that the transaction is executed smoothly and help with post-merger integration.

- Cross-Border Transactions: Investment banks also facilitate international M&A transactions, where regulatory, cultural, and economic factors vary significantly between countries.

4. Restructuring and Recapitalization

In challenging economic conditions or financial distress, companies may turn to investment banks for restructuring or recapitalization advice. This can involve:

- Debt Restructuring: When companies face difficulties in meeting their debt obligations, investment banks advise on ways to restructure the debt, potentially negotiating with creditors to alter the terms of repayment.

- Recapitalization: This involves altering the company’s capital structure to stabilize its balance sheet, often by issuing new debt or equity or retiring existing securities.

5. Hedging and Risk Management

Investment banks offer services that help clients manage risk associated with changes in interest rates, foreign exchange rates, commodity prices, and other market variables. They create tailored hedging strategies using derivative instruments such as options, futures, and swaps. These strategies protect clients from unfavorable market movements and ensure stability.

6. Structured Finance

Structured finance involves complex financial transactions that are often used for specific purposes, such as securitization. Investment banks design and sell structured products like:

- Collateralized Debt Obligations (CDOs): These are financial products that pool together cash-flow-generating assets like loans or mortgages and then issue securities backed by those assets.

- Mortgage-Backed Securities (MBS): These are securities backed by a collection of mortgage loans. Investment banks package these loans and sell them to investors, passing on the cash flow from the borrowers to the security holders.

7. Proprietary Trading

While proprietary trading has been limited due to regulations like the Volcker Rule (under Dodd-Frank), some investment banks still engage in it to a certain extent. In proprietary trading, investment banks trade stocks, bonds, commodities, and other securities using the firm’s own capital, rather than client funds, to profit from market movements.

How Investment Banks Generate Revenue

Investment banks generate revenue through various streams, and understanding how they make money helps in grasping their role in the financial markets:

1. Underwriting Fees

When investment banks help companies issue new stocks or bonds, they earn underwriting fees for their services. This is usually a percentage of the total value of the securities issued. The higher the size of the offering, the greater the potential revenue for the bank.

2. Advisory Fees

In M&A deals, investment banks charge fees based on the size of the transaction. Typically, the fee structure involves a fixed retainer fee plus a percentage of the transaction’s total value upon successful completion.

3. Trading Commissions

Investment banks earn commissions for executing trades on behalf of their clients. These fees are charged when the bank buys or sells securities, derivatives, or other financial products on the client’s behalf.

4. Management Fees

In their asset management business, investment banks charge a management fee that is typically based on a percentage of the assets under management (AUM). Additionally, some funds may also charge performance fees, which reward the bank for exceeding a pre-set benchmark return.

5. Proprietary Trading

Investment banks can also generate profits through proprietary trading, where they trade their own capital. While this can be highly profitable, it also comes with significant risks.

6. Interest on Loans and Leverage

In leveraged finance deals, such as leveraged buyouts (LBOs), investment banks provide debt financing to private equity firms and earn interest from these loans. Additionally, they can earn fees for structuring the transaction.

Investment Banking vs. Commercial Banking

The differences between investment banking and commercial banking are crucial to understand, especially since the two types of banking are often confused. Here’s a detailed comparison:

1. Clients

- Commercial Banks: Primarily serve individuals and small-to-medium-sized enterprises (SMEs). Services include deposit accounts, loans, credit cards, and mortgages.

- Investment Banks: Cater to large corporations, institutional investors, governments, and high-net-worth individuals. Their services focus on raising capital, providing advisory services, and facilitating securities trading.

2. Services

- Commercial Banks: Provide everyday banking services, such as checking and savings accounts, personal loans, business loans, and safe deposit boxes.

- Investment Banks: Specialize in underwriting new debt and equity, advisory for mergers and acquisitions, trading of securities, and financial risk management.

3. Regulation

- Commercial Banks: Subject to stringent regulations to ensure they can meet their obligations to depositors. They are often required to hold a large percentage of deposits in reserve.

- Investment Banks: Face less strict reserve requirements but are subject to complex financial regulations aimed at limiting risk-taking behavior. Investment banks that are part of universal banks (e.g., JPMorgan Chase) are subject to both commercial and investment banking regulations.

4. Risk Profile

- Commercial Banks: Have a lower risk profile because they deal with relatively straightforward transactions like deposits and loans. They earn primarily through interest rate differentials (lending at higher rates than they borrow).

- Investment Banks: Have a higher risk profile, especially when engaging in proprietary trading, underwriting, or M&A transactions. They can potentially lose large sums on unsuccessful deals or trades.

Investment Banking in the Global Financial System

Investment banking is a cornerstone of the global financial system. It plays a pivotal role in:

- Capital Formation

Investment banks facilitate the flow of capital between investors and businesses, enabling companies to expand, innovate, and contribute to economic growth. By underwriting securities, investment banks ensure that companies can access the funds they need to invest in new projects, create jobs, and stimulate economic activity.

- Liquidity Provision

Investment banks play a crucial role in ensuring that financial markets remain liquid. They do this by acting as intermediaries in buying and selling securities, making it easier for investors to trade without significantly impacting the market price. This liquidity enables businesses and governments to raise capital more efficiently and allows investors to enter and exit positions without undue delay. - Facilitating Risk Management

Through the use of derivatives and other complex financial instruments, investment banks help companies and investors hedge against various types of risks, such as currency fluctuations, interest rate changes, and commodity price volatility. This risk management service allows businesses to focus on their core activities without being overly exposed to adverse market movements. - Promoting Market Efficiency

By conducting thorough research and providing market analysis, investment banks contribute to market transparency and efficiency. Their reports and recommendations enable investors to make more informed decisions, reducing information asymmetry and improving price discovery in financial markets. - Global Economic Integration

Investment banks operate in multiple countries and have a deep understanding of global financial markets. Their cross-border services help facilitate international trade, investment, and economic integration. Through mergers and acquisitions, capital raising, and advisory services, investment banks enable companies to expand internationally and foster economic growth on a global scale.

The Process of Initial Public Offerings (IPOs)

An Initial Public Offering (IPO) is one of the most significant milestones for a company, marking the first time its shares are offered to the public. Investment banks play a key role in guiding companies through this complex process. Here’s a detailed look at the IPO process:

1. Pre-IPO Planning

Before a company can go public, it must prepare itself internally for the transition from a private to a public entity. Investment banks assist in this stage by conducting a financial review, helping the company optimize its corporate structure, and identifying potential risks. They work with the company’s executives and legal teams to ensure all aspects of the business are ready for public scrutiny.

2. Selecting the Underwriter

Companies typically choose one or more investment banks to act as underwriters for the IPO. The underwriters play a critical role in managing the process, pricing the offering, and marketing it to potential investors. Companies usually select investment banks based on their track record, market reach, and industry expertise.

3. Valuation and Pricing

One of the most crucial aspects of the IPO process is determining the valuation of the company. Investment banks use several methods, including comparable company analysis (comps), discounted cash flow (DCF) analysis, and precedent transactions to arrive at a valuation. Once the valuation is established, the banks will work with the company to determine the price per share.

4. Regulatory Filings

In the U.S., companies must file an S-1 registration statement with the Securities and Exchange Commission (SEC) before going public. This document contains detailed financial statements, business information, and risk factors. Investment banks help prepare this filing and ensure that all regulatory requirements are met.

5. Roadshow

The roadshow is an essential part of the IPO process, where the company’s management team, along with the investment bankers, present the business to institutional investors. This tour of presentations and meetings helps gauge interest in the IPO and helps determine the final pricing. Feedback from the roadshow allows underwriters to adjust the offering price and the number of shares to be sold.

6. Pricing and Allocation

After completing the roadshow, the investment banks and the issuing company decide on the final offering price. This is based on investor demand, market conditions, and the company’s valuation. The investment banks will also determine how many shares each investor will receive. In a typical IPO, the majority of shares are allocated to institutional investors such as mutual funds, hedge funds, and pension funds.

7. Going Public

On the day of the IPO, the company’s shares are listed on a stock exchange, such as the New York Stock Exchange (NYSE) or NASDAQ. The shares begin trading publicly, and the market determines the actual trading price, which may differ from the offering price depending on investor demand.

8. Post-IPO Stabilization

After the IPO, investment banks may engage in post-IPO stabilization by buying or selling shares to reduce price volatility. This process, known as “green-shoe” or overallotment, allows the underwriter to purchase additional shares to meet demand or sell them to reduce supply and support the stock’s price.

Mergers and Acquisitions (M&A)

Mergers and acquisitions (M&A) represent a significant portion of investment banking activities. Whether advising on a multi-billion-dollar acquisition or facilitating the merger of two smaller firms, investment banks provide critical guidance at every stage of the process. Here’s a closer look at the various aspects of M&A:

1. Types of M&A Transactions

- Horizontal Mergers: Occur when two companies in the same industry combine, often with the goal of increasing market share or achieving economies of scale.

- Vertical Mergers: Involve companies at different stages of the supply chain merging, such as a manufacturer acquiring a supplier.

- Conglomerate Mergers: Involve companies in unrelated industries, often as a strategy to diversify and reduce risk.

- Acquisitions: Occur when one company buys another, either through a cash transaction, stock deal, or a combination of both.

2. Buy-Side vs. Sell-Side Advisory

- Buy-Side Advisory: In this role, investment banks represent the buyer. They conduct due diligence, analyze potential targets, negotiate deal terms, and arrange financing. The buy-side is responsible for ensuring that the acquisition adds strategic value to the buyer and fits their long-term goals.

- Sell-Side Advisory: Here, the bank represents the company being sold. The sell-side helps market the company to potential buyers, determine an appropriate valuation, and negotiate favorable terms. The goal is to achieve the highest possible sale price for the client.

3. Valuation Techniques

Investment banks use several methodologies to determine the value of the companies involved in an M&A transaction:

- Comparable Company Analysis (Comps): This method involves comparing the target company with similar companies in the same industry.

- Precedent Transaction Analysis: This method looks at past M&A transactions in the same industry to determine an appropriate valuation multiple.

- Discounted Cash Flow (DCF): The DCF method involves forecasting a company’s future cash flows and discounting them back to present value using a weighted average cost of capital (WACC).

4. Due Diligence

Due diligence is an essential part of any M&A transaction. Investment banks work with legal, financial, and operational teams to review all aspects of the target company, including its financial statements, contracts, liabilities, and intellectual property. The goal is to identify any risks or issues that could affect the value of the deal.

5. Negotiation and Deal Structuring

Investment banks play a key role in negotiating the terms of the deal. This involves determining the structure of the transaction (cash, stock, or a mix), setting milestones for closing the deal, and ensuring that both parties’ interests are represented fairly. In complex deals, investment banks may also help arrange financing, such as through leveraged loans or bonds.

6. Closing the Deal

After negotiations are finalized, the deal must go through regulatory approval (if necessary) and receive shareholder approval. Investment banks coordinate the final stages, ensuring all documents are in place, funds are transferred, and legal requirements are met. Once the deal is closed, the acquiring company assumes control of the target, and the transaction is complete.

7. Post-Merger Integration

The success of an M&A deal often depends on how well the two companies integrate after the transaction. Investment banks may provide guidance on post-merger integration, helping the combined company realize the synergies that justified the deal in the first place. This could involve streamlining operations, combining product lines, or aligning corporate cultures.

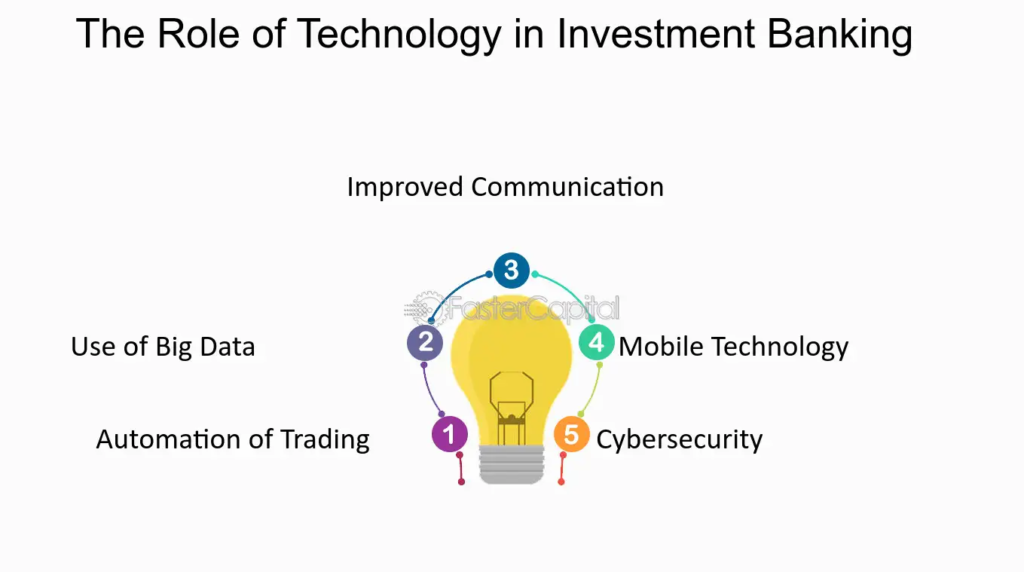

The Role of Technology in Investment Banking

Technology has transformed the way investment banks operate, improving efficiency, enhancing security, and enabling new financial products. Here’s a detailed exploration of how technology is reshaping the industry:

1. Algorithmic Trading

Investment banks use sophisticated algorithms to execute trades at high speed and with minimal human intervention. Algorithmic trading helps banks execute large orders by breaking them down into smaller trades to minimize market impact. It also allows for more precise execution, lower transaction costs, and reduced human error.

2. Blockchain and Cryptocurrencies

Blockchain technology has the potential to revolutionize investment banking by enabling faster, more secure, and transparent transactions. Some investment banks are exploring the use of blockchain for clearing and settling trades, issuing digital securities, and enhancing cybersecurity. Cryptocurrencies, while still in their infancy in institutional finance, are being considered for inclusion in investment portfolios.

3. Artificial Intelligence (AI) and Machine Learning

AI and machine learning are being used in various areas of investment banking, from predictive analytics in trading to automating back-office functions like compliance and regulatory reporting. AI-driven algorithms analyze large data sets to identify patterns and make more informed trading decisions. Machine learning models can also assist with fraud detection, risk management, and customer service.

4. Robotic Process Automation (RPA)

Investment banks are increasingly using RPA to automate routine tasks, such as data entry, reporting, and transaction processing. This reduces operational costs, improves accuracy, and frees up human employees to focus on more complex, value-added activities.

5. Cybersecurity

As the reliance on digital platforms grows, cybersecurity becomes a top priority for investment banks. With sensitive financial data at risk, banks invest heavily in cybersecurity technologies like encryption, multi-factor authentication, and advanced threat detection systems to protect their systems from cyberattacks. Investment banks must also comply with stringent data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe, to safeguard client information.

6. Big Data Analytics

Big data analytics is another critical technology reshaping investment banking. Banks collect vast amounts of data from financial markets, social media, client interactions, and other sources. By applying analytics, they can gain insights into market trends, client preferences, and risk factors, helping them make more informed investment decisions. For example, investment banks use sentiment analysis to gauge market sentiment, potentially predicting shifts in stock prices.

7. Fintech Partnerships

Many investment banks are collaborating with financial technology (fintech) companies to innovate their services. Fintech firms offer cutting-edge solutions in areas such as digital lending, robo-advisory, and blockchain-based payment systems. By partnering with fintechs, investment banks can stay competitive and adapt to the fast-evolving financial landscape.

Key Challenges Faced by Investment Banks

Despite their crucial role in global finance, investment banks face numerous challenges. These challenges stem from regulatory pressures, market volatility, technological disruption, and evolving client expectations.

1. Regulatory Compliance

Following the 2008 financial crisis, regulatory oversight of investment banks has intensified globally. Regulations like the Dodd-Frank Act in the U.S. and Basel III internationally impose capital requirements, liquidity ratios, and risk management protocols. Complying with these regulations can be costly and burdensome, forcing investment banks to adopt more conservative business practices. Fines and penalties for non-compliance further strain resources and reputations.

2. Market Volatility

Investment banks are particularly vulnerable to market volatility. Changes in interest rates, currency fluctuations, political instability, and economic downturns can significantly affect profitability. For example, during economic slowdowns, companies tend to delay mergers, acquisitions, and IPOs, leading to lower fee generation for banks. Similarly, unpredictable swings in market sentiment can impact trading revenue.

3. Technological Disruption

While technology offers numerous benefits, it also presents challenges. Fintech companies are increasingly disrupting traditional investment banking services, offering faster, more cost-effective alternatives. For instance, robo-advisors are taking over some wealth management functions, while blockchain technology threatens to disintermediate traditional financial transactions. Investment banks must continuously innovate to stay ahead of fintech competition.

4. Cost Pressures

Investment banks face mounting cost pressures due to several factors, including compliance costs, the need for technological upgrades, and competition. To remain profitable, many investment banks are focusing on reducing operational costs through automation, outsourcing, and downsizing certain business lines. However, balancing cost reduction while maintaining service quality is a delicate task.

5. Talent Retention

Attracting and retaining top talent is a constant challenge for investment banks. The demanding work environment, long hours, and high-pressure culture often lead to burnout. Additionally, the rising prominence of tech companies and startups has created alternative career paths for skilled professionals who may opt for less stressful roles outside of banking. Investment banks are increasingly focusing on work-life balance, diversity, and employee development programs to retain their workforce.

6. Reputation Management

Reputation risk is a significant concern for investment banks. Negative media coverage, regulatory sanctions, or involvement in unethical behavior can damage a bank’s reputation, leading to loss of clients and revenue. For example, several investment banks faced public backlash and legal action after the 2008 financial crisis due to their role in creating complex financial products like mortgage-backed securities (MBS) and collateralized debt obligations (CDOs).

Skills Required in Investment Banking

A career in investment banking requires a unique combination of technical skills, industry knowledge, and interpersonal abilities. Here’s a detailed look at the essential skills investment bankers need to thrive in this demanding field:

1. Financial Modeling

Investment bankers need to build and interpret complex financial models, often under tight deadlines. These models are used to forecast company performance, value assets, and analyze the financial impact of various scenarios, such as mergers or debt restructurings. Proficiency in tools like Excel, coupled with a deep understanding of valuation techniques, is essential.

2. Analytical Thinking

The ability to analyze vast amounts of financial data, interpret trends, and draw actionable insights is a critical skill for investment bankers. They must quickly assess the potential risks and rewards of deals, make sound recommendations, and ensure their analysis stands up to scrutiny from clients and stakeholders.

3. Negotiation Skills

Investment bankers frequently negotiate high-stakes deals between buyers, sellers, and other stakeholders. Strong negotiation skills help bankers secure the best terms for their clients, whether in M&A transactions, financing agreements, or IPOs. Successful negotiators can balance competing interests while maintaining long-term relationships.

4. Relationship Management

Building and maintaining relationships with clients, institutional investors, regulators, and colleagues is crucial for success in investment banking. Bankers need strong interpersonal skills to manage client expectations, gain trust, and ensure repeat business. Networking and relationship management play a key role in business development, client retention, and deal origination.

5. Attention to Detail

Given the high financial stakes involved in investment banking, even small errors can lead to costly mistakes or legal issues. Bankers must have a meticulous approach to financial documentation, legal agreements, and client communication. Attention to detail is especially important in financial modeling, regulatory filings, and due diligence.

6. Communication Skills

Investment bankers need to communicate complex financial concepts clearly and concisely, whether through written reports, presentations, or verbal communication. They often present their analysis to senior executives, board members, and investors, so they must be persuasive and articulate in their explanations.

7. Time Management and Resilience

Investment bankers work long hours, often juggling multiple transactions, client meetings, and deadlines. Effective time management and the ability to work under pressure are essential skills. Bankers must be highly organized and capable of handling multiple tasks simultaneously while maintaining the quality of their work.

Career Paths in Investment Banking

Investment banking offers numerous career paths, with opportunities to specialize in various areas of finance. Here’s an overview of the typical career trajectory:

1. Analyst (Entry-Level)

Analysts are typically recent college graduates who handle the grunt work, such as financial modeling, market research, and preparing presentations. This is an intensive role with long hours and a steep learning curve, but it offers the opportunity to learn the fundamentals of investment banking.

2. Associate (Post-MBA or Promotion)

Associates manage analysts and are more involved in client interactions. They take on greater responsibility for executing deals, preparing reports, and assisting with negotiations. Many associates come from MBA programs or are promoted from the analyst role.

3. Vice President (VP)

Vice presidents serve as the bridge between senior bankers (directors and managing directors) and junior staff. They oversee day-to-day deal execution, ensure that client needs are met, and help originate new business. VPs take a more hands-on role in negotiating deals and managing client relationships.

4. Director / Senior Vice President

Directors focus more on business development and client relationship management. They pitch new business, oversee multiple deals simultaneously, and lead teams of bankers. Directors also mentor junior staff and work closely with managing directors to secure major transactions.

5. Managing Director (MD)

Managing directors are at the top of the hierarchy and are responsible for originating deals, managing relationships with key clients, and overseeing large transactions. MDs often focus on a specific sector or geographic region. They are compensated based on the deals they bring in, making this a high-pressure but potentially lucrative role.

Work Culture in Investment Banking

The work culture in investment banking is known for being fast-paced, intense, and competitive. Here are some key aspects:

1. Long Hours

Investment bankers often work 70-100 hours per week, particularly during peak deal periods. The work is deadline-driven, and transactions can require round-the-clock attention. While compensation can be high, maintaining work-life balance is a significant challenge.

2. High Performance Expectations

Investment banking is a results-oriented industry. Bankers are expected to deliver high-quality work under tight deadlines, and mistakes are not easily forgiven. The industry attracts high achievers who thrive under pressure, but it can be stressful for those not accustomed to such demands.

3. Team Collaboration

Despite the competitive nature of the industry, investment bankers often work in teams. Collaboration between analysts, associates, VPs, and senior bankers is essential to manage complex transactions. Teamwork is key to balancing workloads, ensuring accuracy, and delivering results to clients.

4. Client-Centric Focus

Client satisfaction is paramount in investment banking. Bankers must be available at all times to answer client questions, provide advice, or respond to market changes. This client-centric approach can sometimes lead to unpredictable work hours and frequent travel.

5. Meritocracy

Investment banking is often described as a meritocratic industry, where hard work and results are rewarded. Promotions and bonuses are typically based on performance, with top performers earning significant financial rewards and advancing quickly up the ranks.

Future of Investment Banking

The investment banking industry is continually evolving in response to regulatory changes, market dynamics, and technological advancements. Here are some key trends shaping the future of investment banking:

1. Digital Transformation

Investment banks are investing heavily in digital technologies such as AI, blockchain, and big data analytics to improve efficiency, reduce costs, and enhance client service. Automation is expected to take over routine tasks, allowing bankers to focus on more complex, high-value activities.

2. Sustainable Finance

Environmental, social, and governance ((ESG) considerations are becoming increasingly important in investment banking. Clients are more focused on sustainable finance, and investment banks are responding by offering ESG-related financial products and advisory services. This trend is expected to grow as more companies and investors prioritize sustainability and responsible investing.

3. Increased Regulation and Compliance

The post-2008 financial crisis regulatory environment has made investment banking a more tightly regulated industry. This trend is likely to continue, with stricter rules around capital requirements, risk management, and proprietary trading. Compliance costs are expected to rise, pushing banks to find more efficient ways to manage regulatory burdens.

4. Rise of Fintech and Disintermediation

Fintech companies are challenging traditional investment banking models by offering faster, cheaper, and more innovative financial services. Peer-to-peer lending platforms, robo-advisors, and blockchain-based systems are all examples of how fintech is disintermediating banks. Investment banks will need to continue investing in technology and partnerships with fintech firms to stay competitive.

5. Globalization and Emerging Markets

Investment banking is becoming more global, with increased focus on emerging markets like Asia, Africa, and Latin America. These regions offer significant growth potential, and investment banks are expanding their operations to capture new business. Cross-border transactions, international M&A, and capital raising in emerging markets are expected to rise as businesses and governments seek funding for infrastructure, technology, and industrial projects.

6. Diversity and Inclusion

The investment banking industry is placing more emphasis on diversity and inclusion, recognizing that diverse teams lead to better decision-making and improved business outcomes. Many firms are adopting policies to increase gender, racial, and cultural diversity at all levels of the organization. This trend is driven by both social expectations and the business case for diverse talent contributing to innovation and better performance.

7. Decentralized Finance (DeFi)

Decentralized finance, or DeFi, is emerging as a major disruptor in the financial services industry. It refers to blockchain-based financial services that operate without traditional intermediaries like banks. DeFi protocols offer peer-to-peer lending, trading, and insurance services using smart contracts. While still in its infancy, DeFi has the potential to significantly reshape capital markets, offering faster, cheaper, and more transparent financial transactions.

8. ESG and Impact Investing

Impact investing and socially responsible investing (SRI) are gaining traction, with institutional and retail investors alike seeking to align their portfolios with social, environmental, and governance values. Investment banks are responding by launching dedicated ESG advisory services and investment products that cater to these growing investor demands.

9. Rethinking Talent and Work Culture

The future of investment banking will likely see a rethinking of traditional work culture, driven by shifts in employee expectations, remote work trends, and the need for better work-life balance. Many firms are adopting more flexible work policies, focusing on mental health, and creating more inclusive environments to attract and retain top talent.

10. Digital Assets and Cryptocurrencies

Digital assets, including cryptocurrencies like Bitcoin and Ethereum, are becoming increasingly important in financial markets. While traditional investment banks have been slow to embrace digital assets, some are starting to offer crypto-related services, such as custodial services for institutional investors and cryptocurrency trading platforms. As the regulatory environment for digital assets becomes clearer, investment banks are likely to play a more prominent role in this space.

Conclusion

Investment banking remains one of the most dynamic and influential sectors in the global financial system. With its broad range of services—spanning mergers and acquisitions, capital raising, advisory, trading, and risk management—it supports businesses, governments, and investors in achieving their financial objectives. While the industry is evolving in response to technological disruptions, regulatory pressures, and changing client expectations, it continues to play a vital role in facilitating economic growth and innovation.

For those pursuing a career in investment banking, the field offers the opportunity to work on high-impact deals, gain deep financial expertise, and build strong client relationships. However, it also demands a commitment to long hours, constant learning, and the ability to thrive in a fast-paced, high-pressure environment. As the industry continues to innovate and adapt, investment bankers will need to embrace new technologies, develop ESG expertise, and foster inclusive, forward-thinking work cultures to remain competitive in the years ahead.

Ultimately, investment banking is not just about transactions—it’s about shaping the future of industries, markets, and economies. Whether advising on the next big merger, helping a startup go public, or managing the risks of a multinational corporation, investment bankers are at the forefront of global financial markets, driving value for their clients and the economy as a whole.

You might also be interested in – How to Buy a Car: A Comprehensive Step-by-Step Guide